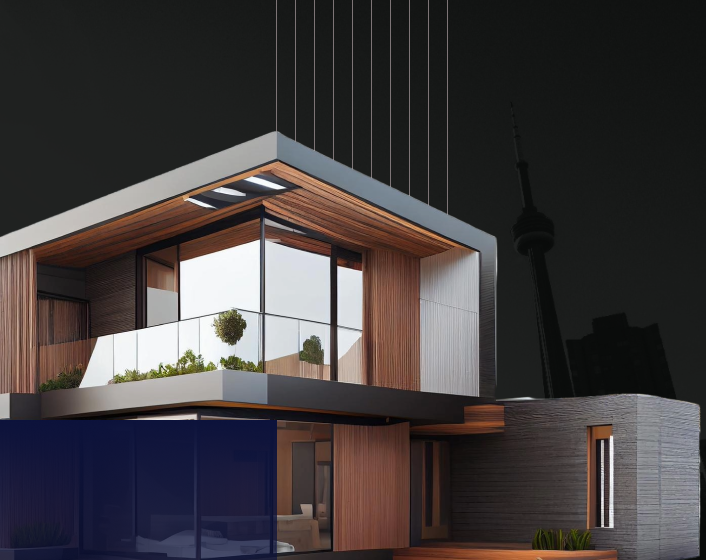

At HuronMortgages.ca, we don’t just offer lending, we structure outcomes. With over $600+M in structured deals and deep, C-suite level experience in commercial development, we guide projects through every phase of the real estate cycle, from acquisition to construction to stabilization.

Including CMHC-backed solutions

Bridge gaps in capital stacks

Subdivisions, townhomes, and servicing loans

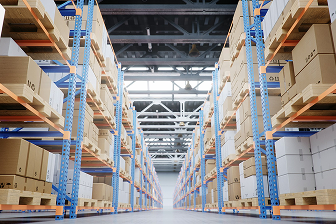

From plazas to logistics hubs

Condos, rentals, and towers

Commercial, Residential, Retail, and Industrial

With strong development upside

Long-horizon opportunities (5+ years)

Long-term strategic holdings